Dear Dave,

Our son is 13, and he has been doing some part-time work for a friend of the family. He makes $40 to $60 a week, and he would like to begin investing the majority of what he earns. Do you have a suggestion for a good place he could put his money?

Lindsay

Dear Lindsay,

Well, here’s the thing. At this point in his life, the goal of this investment isn’t wealth. Number one, it’s not a lot of money. Number two, well, it’s not a lot of money. The goal is to create knowledge, reward his interest in the subject and teach him how to handle his finances when he’s an adult.

I’ve got no problem with you helping him open checking or savings accounts at a local bank or credit union. There are lots of good lessons to be learned in reconciling a bank statement, and the value of spending, saving and giving. Then, you could get with a good financial pro, one with the heart of a teacher, and let him open a mutual fund for $50 a month with you as the custodian. He could learn about compound interest, how to calculate the value of his shares and other things, and all that would be a good learning exercise, too.

We did these things with our kids. But keep in mind that over the course of a year—and when you’re 13, that’s an eternity—there’s not going to be a lot of action on the investing side of things. It could be kind of boring for him at times. But he’s better off to learn now that good things don’t always come with flashing lights and whistles.

When it comes to wealth building, things aren’t sexy. Slow and steady wins the race!

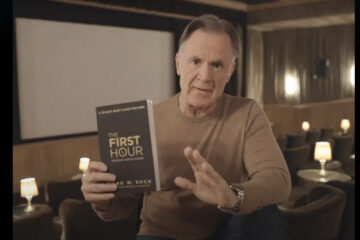

Dave Ramsey is a seven-time #1 national best-selling author, personal finance expert, and host of The Ramsey Show, heard by more than 18 million listeners each week. Hehas appeared on Good Morning America, CBS This Morning, Today Show, Fox News, CNN, Fox Business, and many more. Since 1992, Dave has helped people regain control of their money, build wealth and enhance their lives. He also serves as CEO for Ramsey Solutions.